What Is Leverage in Trading? A Beginner’s Guide

Leverage is one of the most powerful tools in trading, allowing traders to control larger positions with a smaller amount of capital. It is commonly used in markets such as forex, stock CFDs, commodities, and cryptocurrencies. While leverage can amplify potential profits, it also increases the risk of significant losses.

Understanding how leverage works, its benefits, and the risks involved is essential for anyone looking to trade responsibly. This article will explain leverage in simple terms, show examples of how it works, and provide tips for managing the risks associated with it.

What Is Leverage?

Leverage is a financial tool that enables traders to open larger positions than their actual capital would allow. It is provided by brokers as a form of trading credit, allowing traders to control a multiple of their invested amount.

Leverage is expressed as a ratio, such as 10:1, 50:1, or 100:1. This means that for every $1 of capital in your trading account, you can control a trade worth $10, $50, or $100, respectively.

For example, with 10:1 leverage, if you have $1,000 in your account, you can control a position worth $10,000 in the market.

Leverage is widely used in forex trading, CFDs, and futures markets, where traders aim to profit from small price movements.

How Does Leverage Work?

Let’s break it down with a simple example.

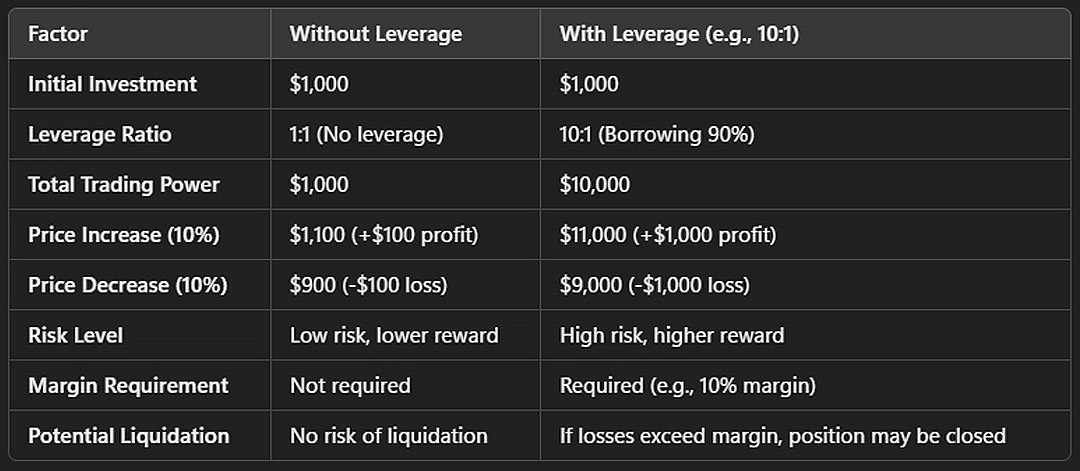

Without leverage, an investor with $1,000 can only trade assets worth up to $1,000. However, with a 10:1 leverage ratio, the same investor can control a position worth $10,000 by using $1,000 as margin and borrowing the remaining $9,000.

For example, if the asset’s price increases by 10%, the investor without leverage would see their capital grow to $1,100, resulting in a $100 profit. In contrast, with 10:1 leverage, the total position size would increase to $11,000, generating a $1,000 profit—ten times higher than without leverage.

However, leverage also magnifies losses. If the asset’s price drops by 10%, the investor without leverage would lose $100, reducing their capital to $900. But with 10:1 leverage, the trader’s position would shrink to $9,000, causing a $1,000 loss—potentially wiping out the entire initial investment.

Leverage increases both risk and reward, making it a double-edged sword. While it allows traders to access larger positions with less capital, it also exposes them to greater financial risk, including the possibility of liquidation. If losses exceed the margin requirement, the broker may forcibly close the trader’s position to prevent further losses.

Leverage is commonly used in forex, futures, CFDs, and stock margin trading. To use it effectively, traders must manage risk carefully, set stop-loss orders, and ensure they have enough margin to sustain market fluctuations.

Leverage Ratios Explained

Different markets and brokers offer varying leverage ratios. Here are some common leverage levels across different asset classes:

- Stock Trading (Traditional Investing): Usually no leverage unless using margin accounts.

- Forex Trading: Common leverage ratios range from 10:1 to 100:1, depending on the broker and regulations.

- CFD Trading: Leverage ratios typically range from 5:1 to 30:1, depending on the asset type.

- Cryptocurrency Trading: Some brokers offer leverage up to 50:1 or higher, but this is extremely risky.

The higher the leverage, the greater the risk of rapid losses if the market moves against you.

The Benefits of Leverage

- Increased Market Exposure – Traders can control larger positions with a smaller amount of money, increasing the potential for profits.

- Greater Trading Opportunities – Leverage allows traders to enter multiple trades simultaneously, diversifying their portfolio.

- Short-Term Profit Potential – Since leverage enhances gains, it is useful for day traders and swing traders looking to capitalize on short-term price movements.

- Flexibility in Capital Usage – Instead of committing all your capital to one trade, leverage allows traders to spread their funds across multiple trades.

While these advantages sound appealing, leverage is a double-edged sword.

The Risks of Using Leverage

- Amplified Losses – Just as leverage can increase profits, it can also lead to devastating losses if the market moves in the wrong direction.

- Margin Calls – If your trade goes against you, your broker may issue a margin call, requiring you to add more funds to your account or risk having your position closed automatically.

- Increased Market Sensitivity – Even small price movements can have a huge impact when trading with high leverage, making leveraged trading highly volatile.

- Not Suitable for Beginners – Many new traders overuse leverage without fully understanding the risks, leading to quick losses.

How to Manage Leverage Risks

- Use Lower Leverage – Just because high leverage is available doesn’t mean you should use it. Beginners should start with lower leverage levels, such as 5:1 or 10:1.

- Set Stop-Loss Orders – A stop-loss order automatically closes a trade if the market moves against you beyond a certain level, preventing excessive losses.

- Trade Small Position Sizes – Risking a small percentage of your capital per trade helps protect your account from large drawdowns.

- Monitor Margin Levels – Keep an eye on your margin level to ensure you don’t get caught in a margin call.

- Learn Before You Trade – Practicing with a demo account before trading real money helps traders understand how leverage affects trades without financial risk.

Should You Use Leverage?

Leverage is a powerful but risky tool. It can work in your favor if used correctly, but it can also lead to large losses if mismanaged.

If you are a new trader, it’s best to start with low leverage or no leverage at all until you fully understand how it affects your trades. More experienced traders who have strong risk management strategies can use leverage carefully to enhance their returns.

The key to using leverage successfully is controlling risk, staying disciplined, and not overextending your account.

Conclusion

Leverage allows traders to control larger positions with a smaller amount of capital, making it a useful tool in forex, CFD, and commodities trading. However, it also increases risk, making it essential to use proper risk management techniques.

If used wisely, leverage can be an effective way to maximize returns while minimizing risk. However, if used recklessly, it can lead to significant financial losses.

Before using leverage, traders should take time to learn, practice with a demo account, and develop a solid risk management plan to ensure they are trading safely and effectively.